Risks involved in the export of Goods

In an international sales contract, the Seller, Buyer, carrier and underwriter are all subject to risks in their relationships with each other. These can be minimised by having a sales contract and using the international commercial terms (Incoterms).

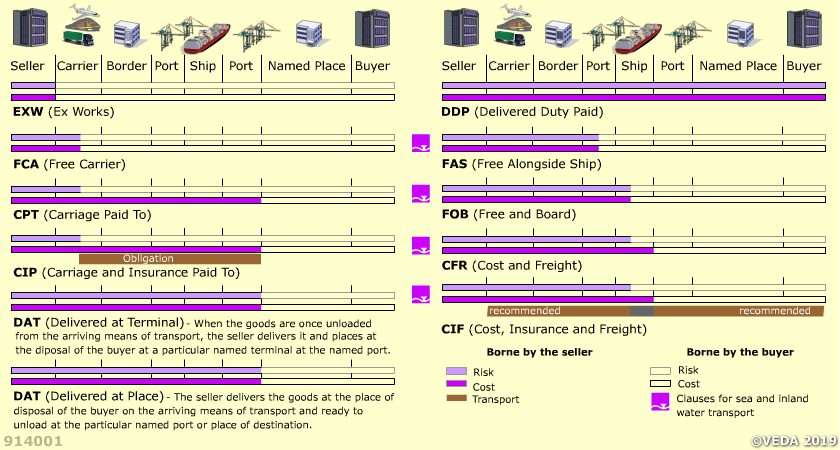

Incoterms are most important in defining the risk distribution between parties involved in the transportation of goods from origin to destination in international trade. They also help eliminate common barriers in a sales contract.

The risks in relationships in the export of goods are as follows:

Seller & BuyerThe Seller will find it difficult to enforce a right of property several miles away and therefore may find it difficult to get payment from the Buyer even though the goods are according to specifications of the negotiated sales contract between an international Buyer and Seller.

The Buyer on the other hand is not sure that the goods meet the specifications as per the negotiated sales contract, when he makes payment before delivery.

Seller/Buyer & the CarrierEven though the Seller has fulfilled his part of the bargain he could incur loss in the sale if there are delays in transportation. The Buyer on the other hand could lose if the goods are damaged during transit. The Carrier would be liable for damages if damage to goods was caused by the vessel not being seaworthy at the beginning of the voyage.

Seller/Buyer & UnderwriterThe Underwriter will have to pay claims for damage and delay, provided there was no negligence on the part of the Carrier. Normally the risk of damage during transportation of goods is transferred to the Buyer once the goods are loaded on the vessel, even though the Seller may have arranged the insurance for the transport of the goods depends on the Incoterm.

Seller/Buyer and FinancierThe Financier of the sale will lose if the Buyer does not make payment to the Seller. This is because the Seller may not be able to repay the loan that may have been taken to finance the manufacture of the good(s).

The payment mode in most international sales contracts is the documentary letter of credit. In this mode of payment the onus rests with the Seller’s bank to ensure that the goods are in conformance with the sales contract before releasing payment.