Principle of Insurable Interest

The principle of insurable interest states that the person getting insured must have insurable interest in the object of insurance. A person has an insurable interest when the physical existence of the insured object gives him some gain but its non-existence will give him a loss. In simple words, the insured person must suffer some financial loss by the damage of the insured object.

For example:- The owner of a Ship or any maritime asset FSO/FPSO/Supply vessel etc has insurable interest in the Ship or any maritime asset because owner is getting income from it. But, if owner sells it, then the owner will not have an insurable interest.

From above example, we can conclude that, ownership plays a very crucial role in evaluating insurable interest. Other simple examples are, A merchant has insurable interest in business of trading. Similarly, a creditor has insurable interest in the form of debtor.

Insurable interestFor the purpose of charter, it is the shipowner’s absolute obligation to provide a seaworthy vessel. At the time the contract is made, the vessel must be fit to encounter the “ordinary perils of the sea” and other incidental risks to which she will be exposed during the voyage. However, the common law recognizes that owners cannot guarantee their vessels’ seaworthiness once they have left port, so the obligation is only imposed at the start of the voyage, i.e. when the vessel leaves the berth either under her own power or under tow. Seaworthiness has three aspects technical seaworthiness, cargo worthiness, and fitness for the intended voyage.

A ship may be held to be unseaworthy if she sails without:

- Statutory certificates in force

- Certificate (or interim certificate) of class in force

- Cargo spaces properly fitted for the cargo (including ventilation and fire-fighting systems)

- Cargo properly stowed or secured

- Properly qualified Master/officers

- Appropriate (and corrected) charts for the voyage

- Sufficient bunkers for the voyage.

Under the doctrine of stages, seaworthiness at each stage of the voyage, e.g. in dock, in a river, in an estuary, must be considered separately. Inspections are carried out to ascertain the seaworthiness of the vessel and its ability to carry cargo safely. SIRE and CDI are two such ship-vetting programs for oil tankers and chemical tankers, which ensure that the vessels have the required safety and operational condition.

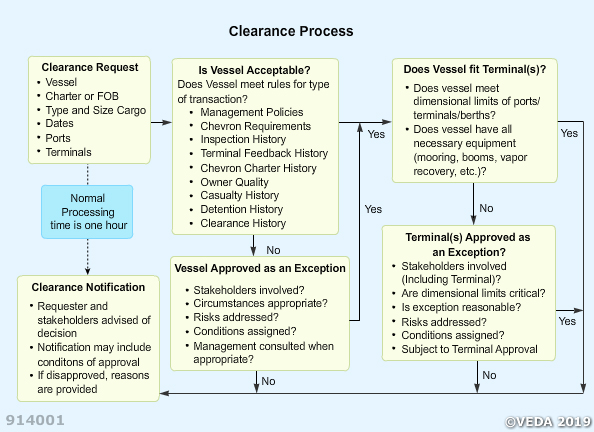

Based on the vetting inspection, a vessel is approved or disapproved for charter. The process chart below illustrates the clearance process.

Once the vetting inspection is complete, operators are rated on a scale of 1 to 1000, with 1000 being the best. These ratings change daily, based on the current and latest inputs, and affect the reputation of the operator in the market. Operators are rated as below:

| Grade | Eligibility |

| A | Highest Rating – Eligible for all business (Time charter, COA, Spot, etc.) |

| B/B+ | Good Rating – Eligible for all business (Time charter, COA, Spot, etc.) |

| B- | Satisfactory Rating – Eligible for all business except Time charter business |

| C | Barely Acceptable Rating – Only eligible for spot voyage business |

| G | Poor Rating – Not eligible for any business |