Documentary Letter of Credit

The Documentary letter of credit is the most common method of payment in International trade. This is because:

- It gives security to both the Buyer and Seller.

- It is safe.

- There are two types: the revocable and irrevocable letters of credit. The irrevocable letter of credit is the most common.

- The letter of credit procedure was drawn up by the International Chamber of Commerce.

The Letter of Credit Procedure

The Letter of Credit Procedure

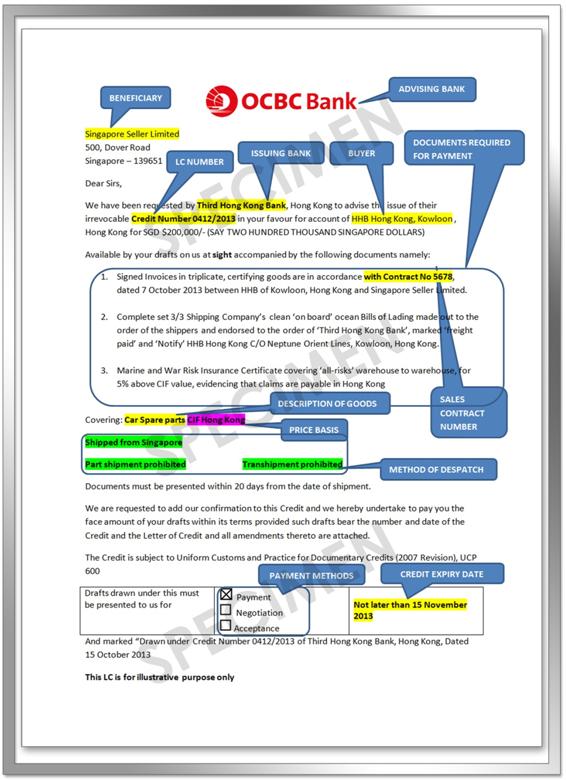

A Letter of Credit

The procedure for the documentary letter of credit method is as below:

- A Sales Contract is signed between the Buyer and Seller.

- The Buyer opens a credit facility with his bank (Issuing or Buyer’s Bank) for the sales price; this information is passed to the Seller via the Advising Bank (Seller’s Bank).

- Once the Seller gets information that the Buyer has deposited money or is solvent, the goods are shipped. The goods shipped must conform to the specifications of the negotiated sales contract.

- The Seller’s bank releases payment to the Seller provided all documents are in order. The documents provide evidence that the goods conform to the negotiated sales contract, are shipped in time and are not damaged at the time of shipment. Documents are passed to the Buyer’s bank and the Seller’s bank receives money from this bank as per agreed terms and conditions, provided all the necessary documents are in order.

The documents that are required to be presented to the advising bank for payment are the following:

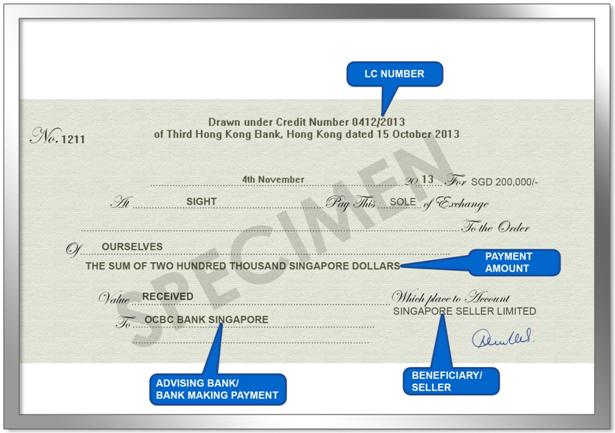

- A sight draft for payment, drawn on the Seller’s bank (the drawee).

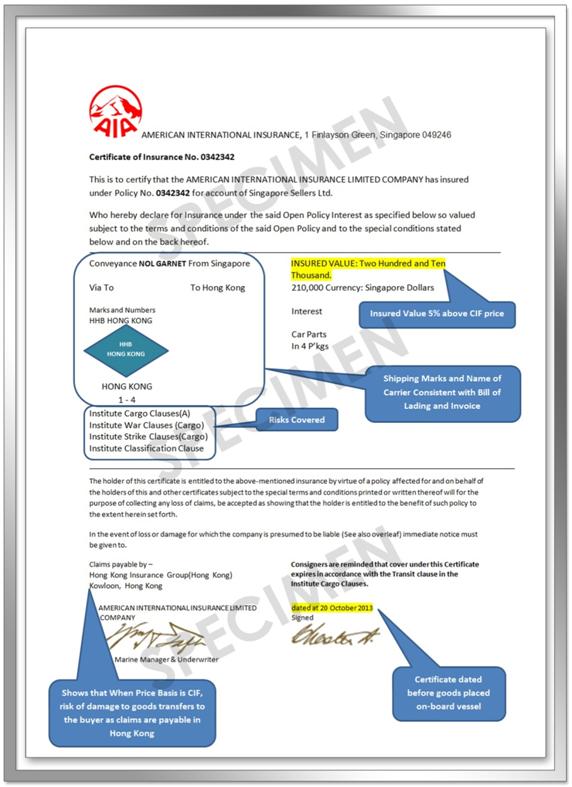

- A certificate of insurance indicating where payment for loss/damage to goods will be made. The cargo insurance policy must be taken before the shipment date.

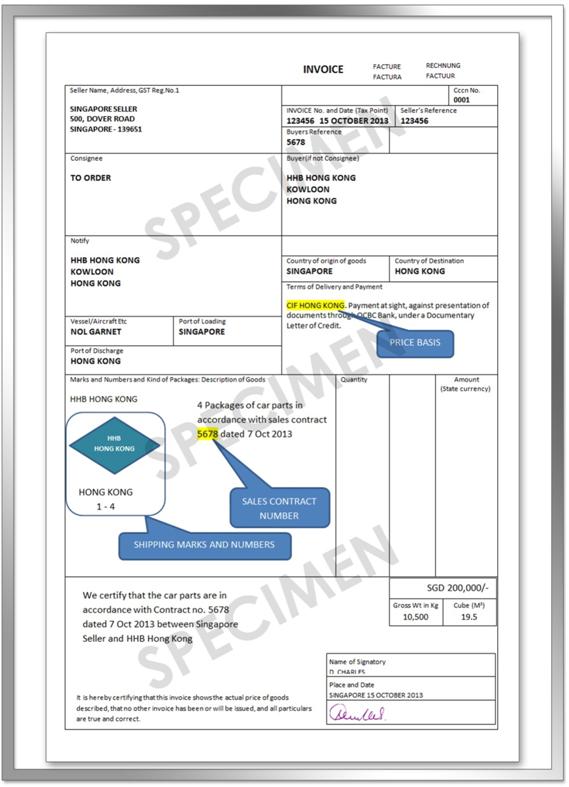

- An invoice, specifying the sales contract and the shipping marks and number of the goods.

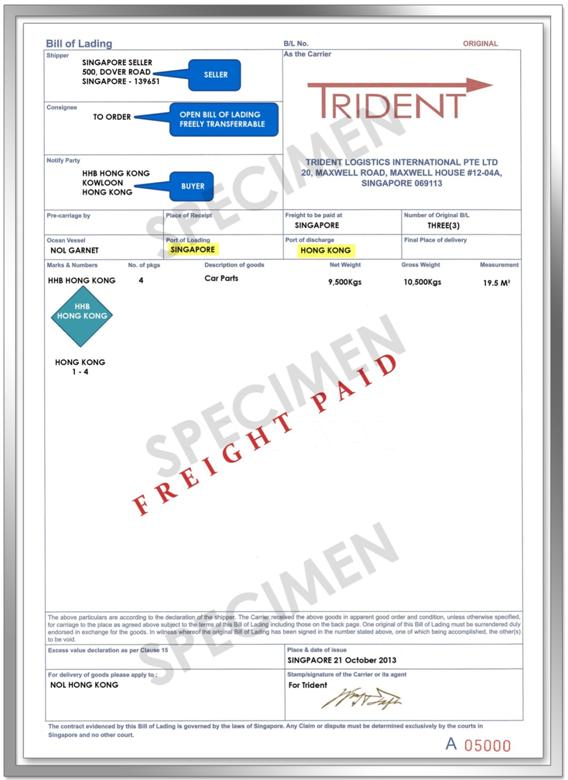

- A clean bill of lading.

The Sight Draft

A Certificate of Insurance

An Invoice

A Clean Bill of Lading